She further said that non-tax revenue mobilisations are also coming up to aid the improving Public Sector Undertakings (PSUs) dividends.

“Second, there are also now PSU dividends which are improving because the valuations have gone up really high and their performance has also now substantially increased. So, revenue mobilisation is not just tax-based, you have non-tax revenue mobilisations which are also coming up,” Sitharaman said.

Also Read: Budget 2024 boosts India’s diamond industry growth & export potential

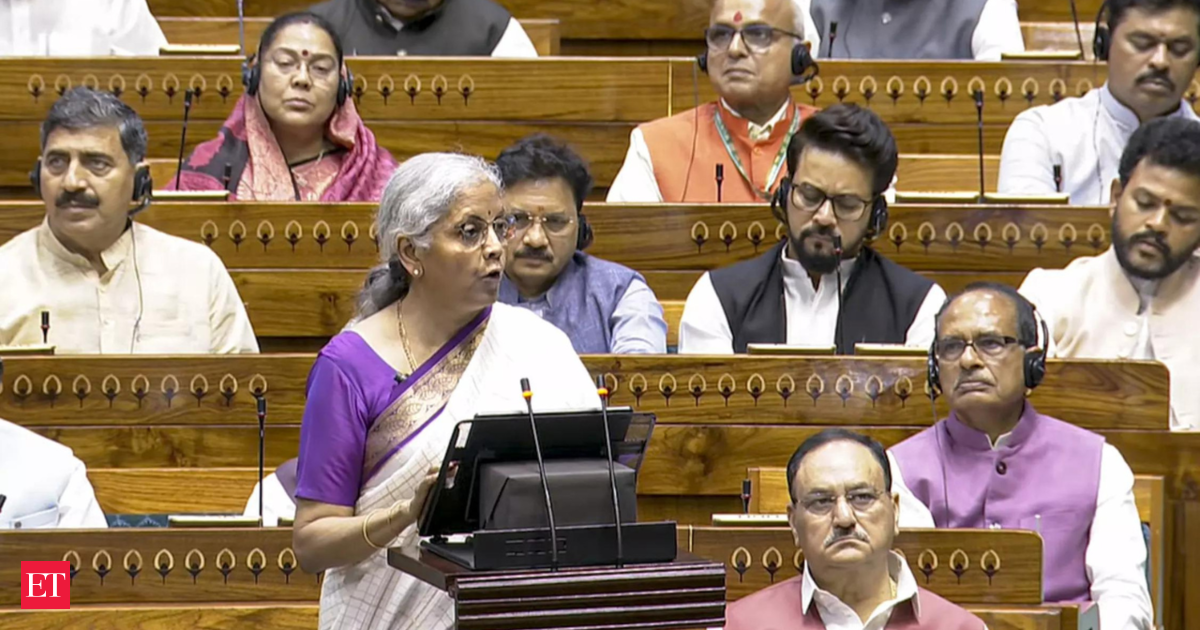

She added: “For three years now, we have been talking about asset monetisation, which is not selling of assets but optimum utilisation of those assets which are lying in the form of unutilised stadiums or land which is available with PSUs which can be utilised for better purposes.”The government collected Rs 19.58 lakh crore as net direct tax in 2023-24, 17.1 per cent more than in the previous fiscal and exceeding the revised estimates by Rs 13,000 crore. India had raised Rs 16.64 lakh crore net direct tax in FY23 and Rs 14.08 lakh crore in fiscal 2022.Also Read: Union Budget 2024-25: Finance Minister Nirmala Sitharaman proposes 12 industrial parks under National Industrial Corridor Program

In the Budget presented today, the Centre aims to raise gross tax revenue of Rs 38.40 lakh crore. According to Budget document, the government now eyes to raise Rs 22.07 lakh crore from direct taxes and Rs 16.33 lakh crore from indirect tax.

Content Source: economictimes.indiatimes.com