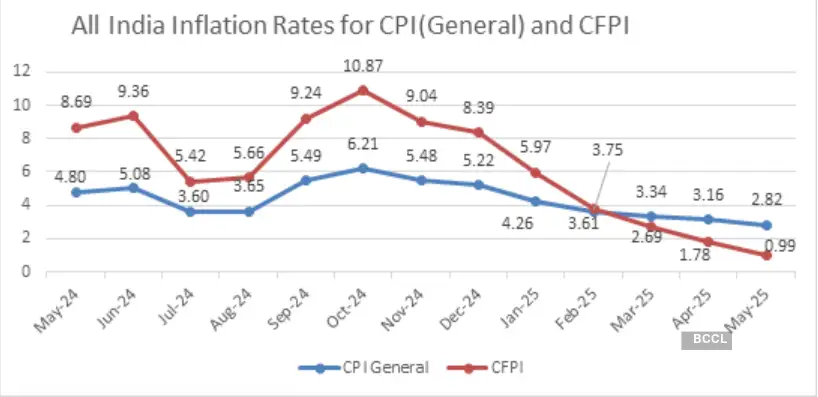

Retail inflation in May was the lowest since February 2019.

A Reuters poll of 50 economists had forecast retail inflation in May to ease to 3%.

The significant easing in May was largely driven by a sharp decline in food inflation, favourable base effects, and lower price increases in essential items.

Food inflation cooled sharply to 0.99% in May 2025 from 1.78% in April, a decline of 79 basis points. Rural food inflation stood at 0.95%, while urban food inflation was 0.96% in May.

May food inflation was the lowest since October 2021, the statement said.

This marks the fourth consecutive month that inflation has stayed below the Reserve Bank of India’s (RBI) medium-term target of 4% and has been lower than the central bank’s tolerance ceiling of 6% for seven straight months.

The data comes nearly a week after the RBI’s Monetary Policy Committee (MPC) cut the benchmark repo rate by 50 basis points to 5.5%, the third consecutive rate cut this year. The policy stance was also shifted from “accommodative” to “neutral”, indicating a more balanced approach to growth and inflation management going forward.

“While the overall inflation trajectory is expected to remain benign, the recent frontloaded policy actions and the guidance of limited room for incremental easing suggests prolonged pause for now, with further actions being highly data dependant,” Upasna Bhardwaj, Chief Economist, Kotak Mahindra Bank, said.

Kitchen staples

Vegetable prices registered a year-on-year decline of 13.7% in May, from an 11% drop recorded in April.

Cereal inflation moderated, with prices rising 4.77% in May compared to 5.35% in the previous month.

Prices of pulses saw a steeper fall, dropping 8.22%, compared to a 5.23% decline in April.

“Selected perishable food groups were up modestly on a sequential basis but moderated on annual terms, aiding the headline. Benign core-core prints point to economic slack, supporting recent moves to frontload monetary and liquidity stimulus. Monsoon developments warrant attention, after progress stalled following an early onset. For the full year, we expect inflation to average below 4%, aligning with our core-core measures,” Radhika Rao, Executive Director and Senior Economist at DBS Bank.

The decline in both headline and food inflation was largely driven by slower price increases in pulses and products, vegetables, fruits, cereals and products, household goods and services, sugar and confectionery, and eggs, the government noted.

“Today’s print further confirms the moderating inflation trend witnessed over the last few months on the back of healthy agriculture supply. We expect the next inflation print to also be close to or below 3%. Beyond that, the progress of the monsoon season could become critical to gauge any risk of food inflation spikes,” Sakshi Gupta, Economist at HDFC Bank, told Reuters.

In rural India, headline inflation eased to 2.59% in May from 2.92% in April 2025, with rural CFPI at 0.95% in May compared to 1.85% the previous month.

In urban areas, headline CPI dropped to 3.07% in May from 3.36% in April, while urban CFPI fell from 1.64% to 0.96%.

The year-on-year inflation in the fuel and light category eased slightly to 2.78% in May 2025, compared to 2.92% in April. This combined rate, covering both rural and urban sectors, reflects a marginal softening in prices within the category during the month.

Meanwhile, urban housing inflation edged up slightly, rising to 3.16% in May from 3.06% in April 2025.

RBI’s inflation outlook

For FY26, the central bank revised its CPI inflation forecast down to 3.70%, from the earlier projection of 4% made in April. The quarter-wise breakdown now stands at: Q1: 2.9%, Q2: 3.4%, Q3: 3.5%, Q4: 4.4%.

The MPC observed that while inflation has softened considerably since breaching the tolerance band in late 2024, global uncertainties and supply-side risks continue to warrant close monitoring. Nonetheless, the RBI had said the inflation outlook is “evenly balanced” and projected further easing in price pressures in the coming months.

“Inflation has softened significantly over the last six months from above the tolerance band in October 2024 to well below the target, with signs of broad-based moderation,” RBI Governor Sanjay Malhotra said in his post-policy address.

Content Source: economictimes.indiatimes.com